- Main

- Business & Economics - Investing

- Financial Modeling of the Equity...

Financial Modeling of the Equity Market: From CAPM to Cointegration

Frank J. Fabozzi CFA, Sergio M. Focardi, Petter N. KolmFinancial Modeling of the Equity Market is the most comprehensive, up-to-date guide to modeling equity portfolios. The book is intended for a wide range of quantitative analysts, practitioners, and students of finance. Without sacrificing mathematical rigor, it presents arguments in a concise and clear style with a wealth of real-world examples and practical simulations. This book presents all the major approaches to single-period return analysis, including modeling, estimation, and optimization issues. It covers both static and dynamic factor analysis, regime shifts, long-run modeling, and cointegration. Estimation issues, including dimensionality reduction, Bayesian estimates, the Black-Litterman model, and random coefficient models, are also covered in depth. Important advances in transaction cost measurement and modeling, robust optimization, and recent developments in optimization with higher moments are also discussed.

Sergio M. Focardi (Paris, France) is a founding partner of the Paris-based consulting firm, The Intertek Group. He is a member of the editorial board of the Journal of Portfolio Management. He is also the author of numerous articles and books on financial modeling. Petter N. Kolm, PhD (New Haven, CT and New York, NY), is a graduate student in finance at the Yale School of Management and a financial consultant in New York City. Previously, he worked in the Quantitative Strategies Group of Goldman Sachs Asset Management, where he developed quantitative investment models and strategies.

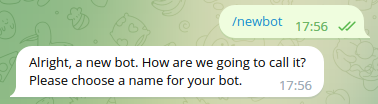

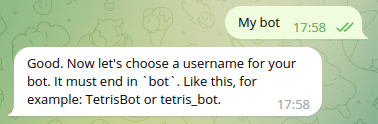

该文件将通过电报信使发送给您。 您最多可能需要 1-5 分钟才能收到它。

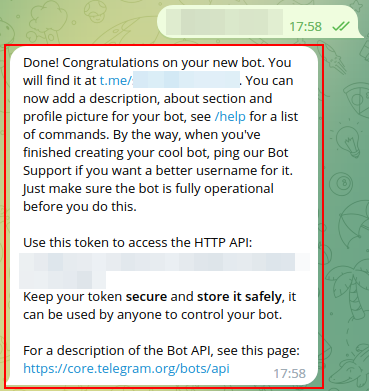

注意:确保您已将您的帐户链接到 Z-Library Telegram 机器人。

该文件将发送到您的 Kindle 帐户。 您最多可能需要 1-5 分钟才能收到它。

请注意:您需要验证要发送到Kindle的每本书。检查您的邮箱中是否有来自亚马逊Kindle的验证电子邮件。

关键词

关联书单

Amazon

Amazon  Barnes & Noble

Barnes & Noble  Bookshop.org

Bookshop.org  转换文件

转换文件 更多搜索结果

更多搜索结果 其他特权

其他特权